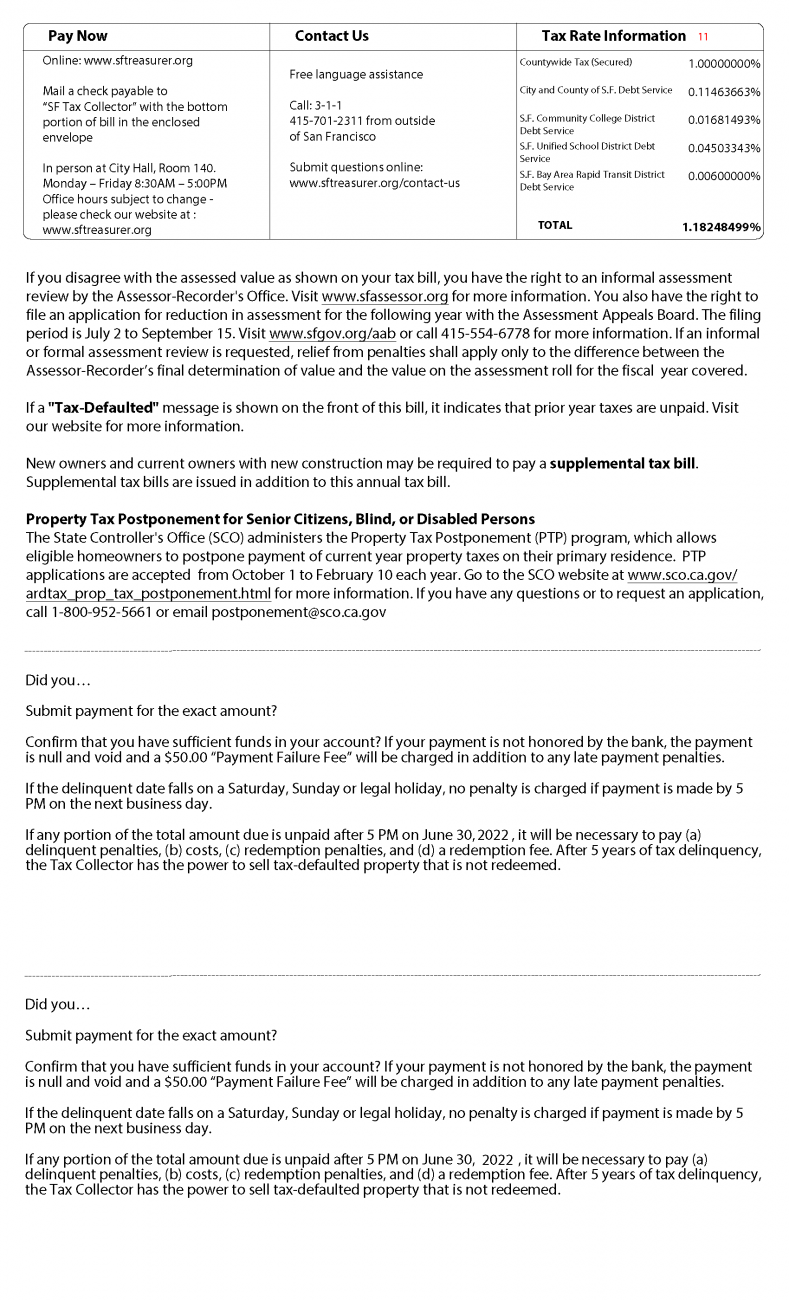

sacramento property tax rate 2020

This rate includes any state county city and local sales taxes. Sacramento county tax rate area reference by primary tax rate area.

Business Property Tax In California What You Need To Know

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate.

. This is the total of state county and city sales tax rates. Property information and maps are available for review using the Parcel Viewer Application. Sacramento County California sales tax rate details The minimum combined 2021 sales tax rate for Sacramento County California is 775.

The California sales tax rate is currently. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Please contact the local office nearest you.

This is the total of state county and city sales tax rates. Category General Last Updated 5th February 2020 How much Sacramento property tax California Property Tax Rates County Median Home Value Average Effective Property Tax Rate Riverside. This tax has existed since 1978.

Total Statewide Base Sales. December 30 2021 fitzy and wippa competition on sacramento county property tax rate 2020 0 views. 3636 American River Drive Suite 200 M ap.

The latest sales tax rate for Sacramento CA. For more information view the Parcel Viewer page. Then used to calculate property taxes the Assessor does not set property tax rates issue tax bills or receive.

2020-2021 Sacramento County Assessment Roll Values are secured and. Permits and Taxes facilitates the collection of this fee. 2020 rates included for use while preparing your income tax.

Learn all about Sacramento real estate tax. What is the Sacramento County tax rate. This is the total of state and county sales tax rates.

The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in which city you are computing the. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. California has a 6 sales tax and Sacramento County collects an additional 025 so.

Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Whether you are already a resident or just considering moving to Sacramento to live or invest in real estate estimate local property tax rates and. Sacramento county collects on average 068 of a propertys assessed fair market value as property tax.

The minimum combined 2022 sales tax rate for Sacramento California is. Tax Collection and Licensing. The minimum combined 2022 sales tax rate for Sacramento County California is 775.

025 to county transportation funds. The California state sales tax rate is currently 6. Sacramento County to apportion and allocate property tax revenues for the period of July 1 2016 through June 30 2019.

This tax is charged on all NON-Exempt real property transfers that take place in the City limits. CDTFA public counters are now open for scheduling of in-person video or phone appointments. For questions about filing.

Revenue and Taxation Code Section 72031 Operative 7104 Total. And the development of the tax rate area TRA annual tax increment. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. View the E-Prop-Tax page for more information. 075 to city or county operations.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Secured Property Taxes Treasurer Tax Collector

Sacramento County Ca Property Tax Search And Records Propertyshark

Business Property Tax In California What You Need To Know

Prop 19 Would Make Changes To California S Residential Property Tax System California Budget And Policy Center

The Property Tax Inheritance Exclusion

The Hidden Costs Of Owning A Home

Business Property Tax In California What You Need To Know

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

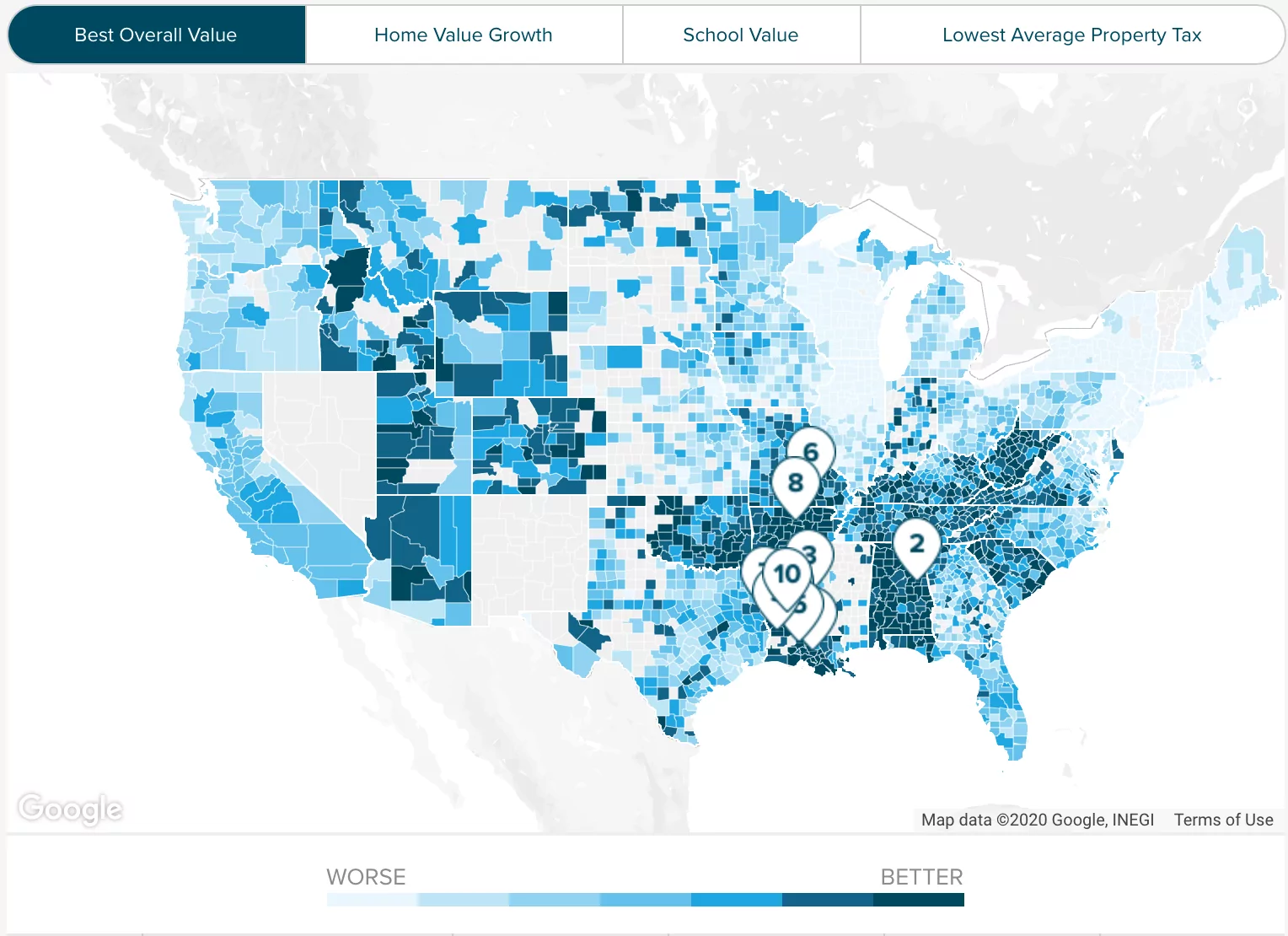

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Riverside County Ca Property Tax Calculator Smartasset

Property Tax California H R Block

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal

Florida Property Tax H R Block

How To Calculate Property Tax Everything You Need To Know New Venture Escrow