selling a car in washington state sales tax

Fees taxes and donations. As of july 28 2019 youll pay 1325 to report.

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

So take my word as i sell cars in washington state.

. According to the sales tax handbook a 65 percent sales tax rate is collected by washington state. Also keep in mind that in the state of washington the most you can be taxed is 20. Renewal and registration fee information.

Allow the Buyer to Have the Car Inspected by a Third Party. Regional Transit Authority RTA tax. 2020 rates included for use while preparing your income tax deduction.

Washington Bill of Sale. According to the sales tax handbook a 65 percent sales tax rate is collected by washington state. Local transportation benefit district fees.

Best And Worst Months To Buy A Used Car According To Data Which U S States Charge Property Taxes For Cars Mansion Global Car Tax By State Usa Manual Car Sales Tax. A make b model and c year. A use tax is charged in the absence of a sales tax.

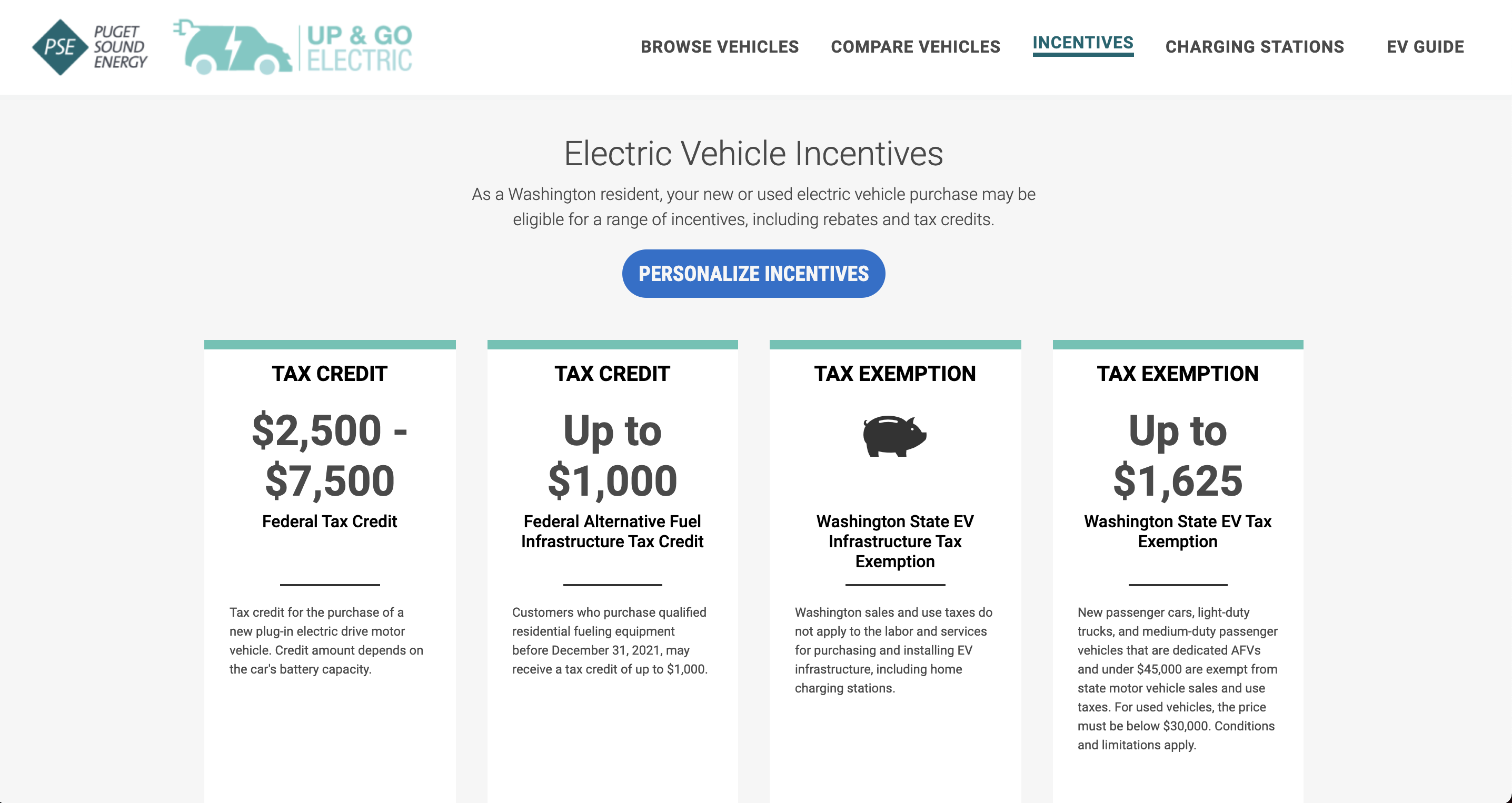

But unlike a sales tax which is based on purchase price a use. In addition to use tax youll be responsible for. How Much Is the Car Sales Tax in Washington.

Washington state department of revenue. Ad Get A Free Quote For Your Used Car - Find Your Car Value By VIN or Model Year. They should prepare two copies.

Vehicles received as gifts If you can provide proof that the person who gave you. For example when you purchase a used vehicle from an individual there is no sales tax involved so the state instead charges a use tax. This number is a sum of the base state sales tax of 65 plus a 03.

The 2021 Washington state sales tax rate of 65 plus a 03 motor vehicle sales lease tax the state tax levied on the purchase or lease of all vehicles is 68. A dealer accepts a trade-in with a fair market. There is also a service and filing fee you have to pay.

Sales tax exemption is still allowed for the full 4000 trade-in value and sales tax is computed on the remaining 6000 of the new purchase price. The state of washington charges 1325 to report the sale of a vehicle. In addition to the general use tax rate vehicles are charged an additional 03 motor vehicle salesuse tax.

However the seller isnt expected to collect the sales tax. Ad Get A Free Quote For Your Used Car - Find Your Car Value By VIN or Model Year. Complete a bill of sale and collect payment.

Selling A Car In Washington State Sales Tax. The Washington state bill of sale must have. Motor vehicle dealers and motor vehicle leasing companies must collect the additional sales tax of three-tenths of one percent 03 of the selling price on every retail sale rental or lease of a motor vehicle in this state.

Sales that are exempt from the retail sales tax are also exempt from the motor vehicle saleslease t See more. Yes you must pay vehicle sales tax when you buy a used car if you. Cars purchased in the state of Washington are subject to a 68 state sales tax but county and local rates can add up to an additional 35 in sales tax.

The buyer is required to complete a bill of sale that you sign to apply for a new title. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. The state sales tax on a car purchase in Washington is 68.

Bills Of Sale In Washington Forms Facts And More

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Register A Car In Washington Metromile

What To Know About Electric Cars In Washington State The Seattle Times

Sales Taxes In The United States Wikipedia

Do You Pay Sales Tax On A Used Car Nerdwallet

Free Bill Of Sale Forms 24 Word Pdf Eforms

Selling To A Dealer Taxes And Other Considerations News Cars Com

How To Close A Private Car Sale Edmunds

What S The Cheapest State To Buy A Car

Car Tax By State Usa Manual Car Sales Tax Calculator

Which State Has The Highest Sales Taxes No Not Washington Opportunity Washington

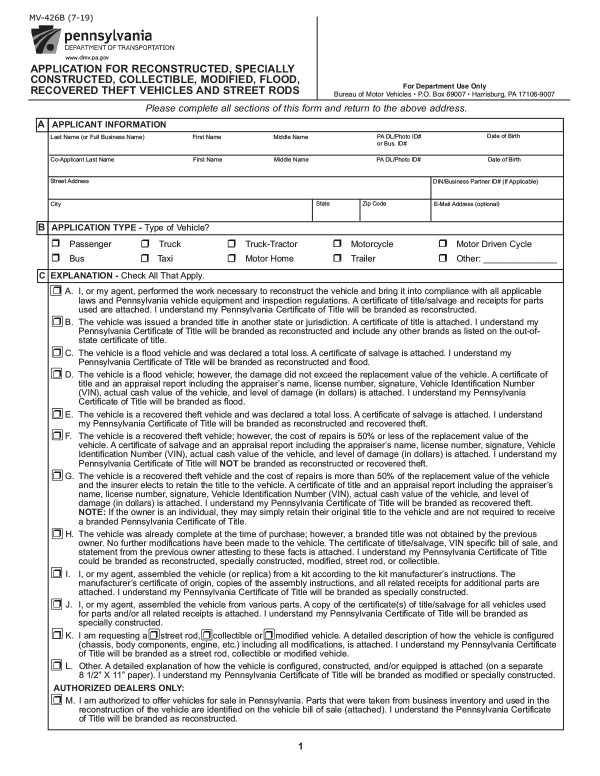

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

How To Register For A Sales Tax Permit Taxjar

Legislators Steer Washington State Toward Direct Electric Vehicle Sales Bypassing Auto Dealers Geekwire

Vehicle And Vessel Licensing King County

Arkansas Sales Tax On Used Vehicles Trailers And Semitrailers Priced Between 4 000 10 000 Now 3 5